Detail Author:

- Name : Francis Tremblay

- Username : evangeline.hackett

- Email : tsipes@konopelski.com

- Birthdate : 1971-06-13

- Address : 9124 Jakubowski Highway Suite 392 West Annie, MA 77326

- Phone : +1-364-845-4989

- Company : Wunsch, Nader and Franecki

- Job : Special Force

- Bio : Nemo saepe libero non cum odio sit. Sint sint nemo eveniet commodi. Molestiae veniam magni delectus est. Modi neque voluptas iusto quidem dolorem sequi.

Socials

instagram:

- url : https://instagram.com/titus.koch

- username : titus.koch

- bio : Odit voluptatum occaecati nemo quia sapiente. Sint dolorem aliquid minus nihil cum officia omnis.

- followers : 5633

- following : 2964

tiktok:

- url : https://tiktok.com/@tkoch

- username : tkoch

- bio : Voluptates et veritatis quas ut cumque consectetur.

- followers : 2105

- following : 544

linkedin:

- url : https://linkedin.com/in/titus.koch

- username : titus.koch

- bio : Ducimus blanditiis ex aut.

- followers : 3448

- following : 2544

It's a common wish, isn't it, to get something you really need or want without having to pay for it all right away? Maybe you're looking at a new appliance, some fresh clothes, or perhaps a gadget that would make life just a little easier. For many folks, having to hand over a big sum of money upfront can be a real sticking point, you know? That's where places like Fingerhut have really come in handy for so long, letting people spread out those payments.

The idea of buying now and paying later, especially with no initial payment, holds a lot of appeal for quite a few reasons. It can help manage your household budget when things are a bit tight, or maybe you're just waiting for your next paycheck. For some, it's a way to get items that are pretty important without having to dip into savings or worry about a large, immediate expense. It's about making purchases more accessible, in a way, for everyday people.

So, if you've been wondering about other places that offer a similar kind of shopping experience, where you can get what you need and pay for it over time, you're certainly not alone. Many people are curious about what other choices are out there beyond the usual spots. We're going to take a look at some of those other options, the ones that let you bring items home without needing to put money down first, which is pretty nice.

Table of Contents

- What Are "No Down Payment" Stores?

- Why Look for Sites Like Fingerhut No Down Payment?

- How Do Sites Like Fingerhut No Down Payment Work?

- What Kinds of Products Can You Get from Sites Like Fingerhut No Down Payment?

- Are There Risks with Sites Like Fingerhut No Down Payment?

- How to Choose the Right Site Like Fingerhut No Down Payment?

- What Are Some Popular Sites Like Fingerhut No Down Payment?

- Can Sites Like Fingerhut No Down Payment Help Your Credit?

What Are "No Down Payment" Stores?

When we talk about places that don't ask for money upfront, we're generally talking about retailers that let you take your items home today and pay for them over a set period of time. This can happen in a few different ways, actually. Some places might offer what's called "store credit," where they give you a spending limit at their particular store, and you pay them back in small bits. Others might use something like a "lease-to-own" arrangement, where you're essentially renting the item with the option to buy it once you've made all the payments. It's a system designed to help people get things when they don't have all the cash right at that moment.

This kind of shopping is really different from just paying with a regular credit card, too. With a credit card, you often need a certain credit history to even get one, and then you're responsible for paying off the balance. With these "no down payment" stores, the focus is often on making it simpler to get approved, sometimes even if your credit history isn't perfect. They usually have their own ways of checking if you're able to make the payments, which might be a bit different from what a bank would look at. So, it's a specific kind of buying plan, often set up to be more flexible for folks who need that extra bit of help with their purchases.

The key thing to remember is that you're still making a commitment to pay for the item. It's not free stuff, by any means. It's just that the initial barrier of a large payment is removed, which can be very helpful for managing personal finances. These places are essentially offering you a way to finance your purchases directly through them, rather than through a separate bank or loan company. This direct approach can feel a little more personal, and perhaps less intimidating for some shoppers, which is nice.

Why Look for Sites Like Fingerhut No Down Payment?

There are a bunch of good reasons why someone might be searching for sites like Fingerhut no down payment. For one, it's a way to get your hands on something important, say a new refrigerator or a laptop for school, when you don't have all the cash sitting around. It helps spread out the cost, making bigger purchases feel a lot more manageable for your wallet. This can be especially useful if you're on a tight budget, or if an unexpected expense has come up and you don't want to drain your savings.

Another reason people often look into these kinds of places is to help build up their credit history. If you're new to credit, or if you've had some bumps in the road with your financial past, making regular, on-time payments to these stores can sometimes show up on your credit report. That, in turn, could potentially help improve your credit score over time, which is pretty valuable for things like getting a car loan or a mortgage later on. It's like a stepping stone, in a way, to a stronger financial standing.

And then, too it's almost, there's the sheer convenience of it all. Imagine you need a new TV, and you can order it online, get it delivered, and just start making small weekly or monthly payments. It removes the stress of having to save up a large sum before you can even think about buying something. For many, this kind of payment arrangement just fits better with their lifestyle and how they manage their money day-to-day. It’s a pretty simple way to get what you need without a big upfront financial hit.

How Do Sites Like Fingerhut No Down Payment Work?

So, how do these places that offer no money down actually operate? Well, it usually starts with you picking out the items you want to buy, just like you would at any other online store. But then, when it comes time to pay, instead of asking for the full amount, they'll have you go through an application process. This application is where they try to figure out if you're a good fit for their payment plan. They might ask for some personal details, like your address, your income, and maybe a few other things to get a sense of your financial situation.

After you apply, the store will look over your information. Some of these places might do a quick check of your credit, but it's often not as strict as what a bank would do for a loan. They're more interested in seeing if you have a steady way to pay them back. Once they approve you, they'll set up a payment schedule. This means you'll have a certain amount to pay every week, every two weeks, or every month, until the item is fully paid for. It's all laid out for you, so you know exactly what to expect, which is good.

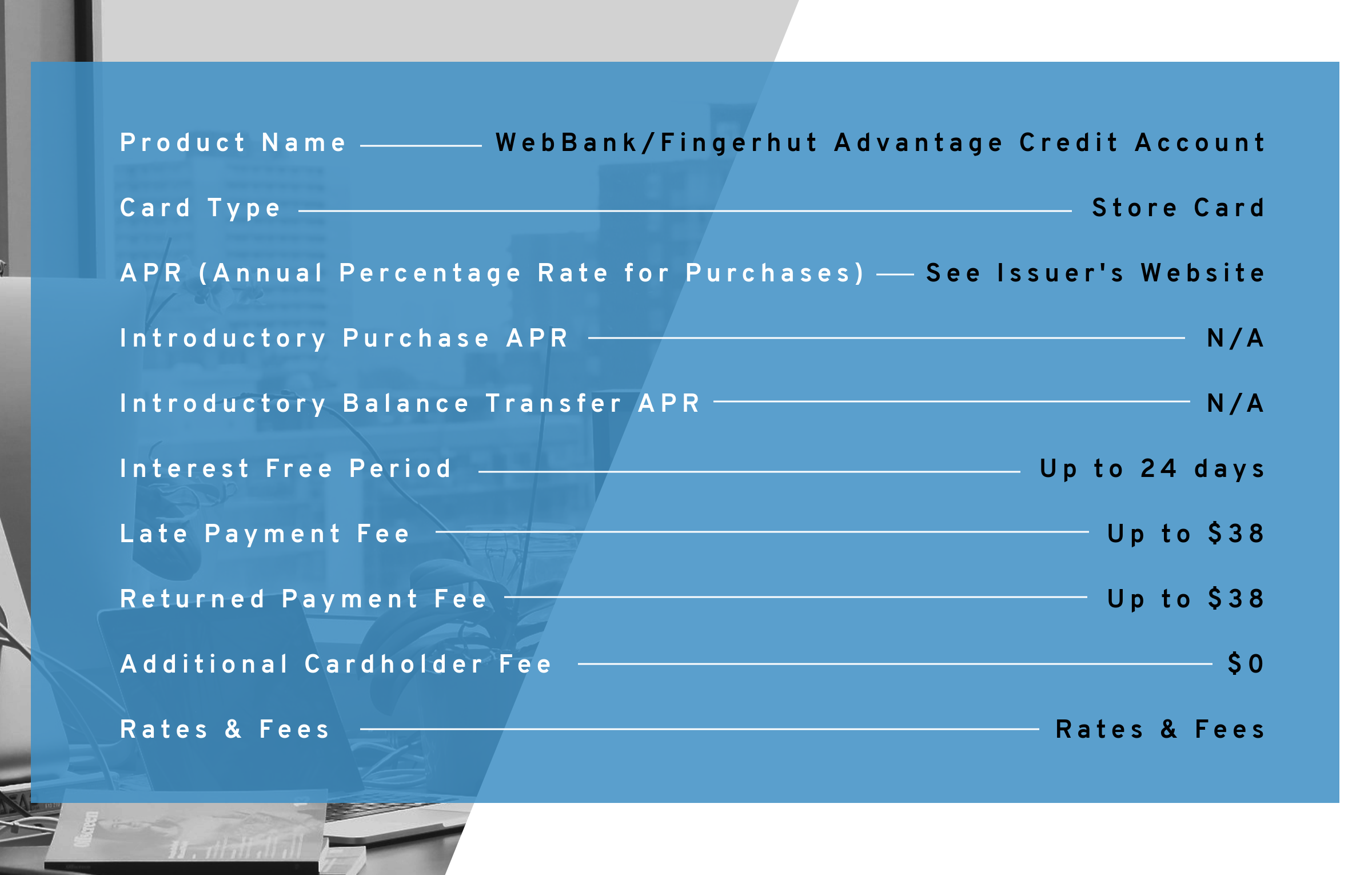

It's really important to pay close attention to the details of these payment plans. They often come with what's called an "interest rate," which is an extra amount of money you pay on top of the item's price for the convenience of paying over time. These rates can sometimes be a bit higher than what you'd see with a traditional bank loan or credit card, so it's always a good idea to understand that part before you agree to anything. They'll also tell you about any fees for late payments, just so you're aware, you know?

What Kinds of Products Can You Get from Sites Like Fingerhut No Down Payment?

When you're looking at sites like Fingerhut no down payment, you'll find that they often carry a pretty wide variety of goods, which is actually quite useful. You can typically find a good selection of things for your home, like furniture, kitchen appliances such as blenders or toasters, and even bigger items like washing machines or refrigerators. These are the kinds of things that can be a bit expensive to buy all at once, so having a payment plan really helps.

Beyond household items, many of these places also offer a range of electronics. Think about things like televisions, laptop computers, tablets, and even some of the latest gaming consoles. Getting these tech items without a big upfront cost can be a real plus for many people, especially if they're needed for work, school, or just for staying connected. They also often have cell phones, which is another common need.

And then, too, you'll often see a selection of clothing for the whole family, from everyday wear to special occasion outfits. Some even have jewelry, watches, or other personal accessories. It really varies from one store to the next, but the general idea is to provide a broad collection of things that people need or want, making them accessible through flexible payment arrangements. So, you might be surprised by just how much you can find.

Are There Risks with Sites Like Fingerhut No Down Payment?

Yes, like with any financial arrangement, there are definitely things to be aware of when you're using sites like Fingerhut no down payment. The biggest thing to keep in mind is that while you don't pay anything upfront, you are still taking on a debt. This means you're promising to pay back the full cost of the item, plus any extra charges, over time. If you don't make those payments as agreed, there can be some consequences that are not so good.

One of the main things to watch out for is the interest rates. As we talked about earlier, these can sometimes be a bit higher than what you might find elsewhere. This means that by the time you've paid off the item, you might have paid quite a bit more than its original price. It's really important to look at the total cost you'll be paying before you commit, so you're not surprised later on. Late fees are another thing; if you miss a payment, they'll usually add a fee, which can make it even harder to catch up.

Also, if you consistently miss payments, it can really hurt your credit standing. These companies often report your payment history to credit bureaus, and if you're not paying on time, that negative information can stay on your credit report for a while. This could make it tougher to get loans or credit cards in the future. So, while these options offer a lot of flexibility, it's really about being responsible with your payments to avoid any financial headaches down the road.

How to Choose the Right Site Like Fingerhut No Down Payment?

Picking the best place among sites like Fingerhut no down payment means looking at a few different things to make sure it's a good fit for you. First off, you'll want to really dig into the terms and conditions. This includes understanding the interest rate they're charging. Is it a fixed rate, or does it change? How much extra will you actually be paying for the item over the payment period? Knowing this upfront helps you compare different places.

Then, consider the range of products they offer. Does the store have the kind of things you're actually looking for? Some places might specialize in electronics, while others might focus more on home goods or clothing. It's also worth checking out their customer service. If you have a question or an issue, will it be easy to get help? Reading reviews from other shoppers can give you a pretty good idea of what their experience has been like, which is very helpful.

Finally, think about the payment schedule itself. Does it work with your budget? Are the weekly or monthly payments something you can comfortably manage without stretching yourself too thin? Some places might offer more flexible payment options than others, so it's worth exploring that, too. You want a plan that feels sustainable for you, so you can make your payments on time and avoid any extra fees or credit issues.

What Are Some Popular Sites Like Fingerhut No Down Payment?

When you're looking for other places that let you pay over time without an initial payment, there are quite a few names that often come up, just like your, Fingerhut. For example, Ginny's is a pretty well-known one. They offer a lot of home items, from furniture to decor, and they have their own credit program where you can make small monthly payments. It's very similar in how it operates, providing a way to get things for your house without needing all the money right away.

Then there's Stoneberry, which is another popular choice. They carry a broad selection of products, including electronics, clothing, and items for the home. Like Ginny's, they offer payment plans that let you spread out the cost, and they often advertise no down payment options. These types of stores are often grouped together because they share that core feature of making purchases more accessible through their own financing arrangements.

You might also hear about places like Gettington, which is actually connected to some of these other companies. They also focus on offering a variety of goods with flexible payment options. Beyond these specific stores, there are also various "lease-to-own" companies or services that work with different retailers. These aren't exactly stores themselves, but they provide the financing, letting you lease an item with the option to buy it later. So, there's a pretty good range of options out there for people looking for sites like Fingerhut no down payment.

Can Sites Like Fingerhut No Down Payment Help Your Credit?

It's a good question, and the answer is that yes, they potentially can help your credit, but it really depends on how you use them. When you make your payments consistently and on time to these kinds of stores, many of them will report that good payment behavior to the major credit reporting bureaus. This positive information then gets added to your credit history, which can, over time, help to build up your credit score. It shows that you are a reliable person when it comes to paying back what you owe.

However, the flip side is just as important to remember. If you miss payments, or if you're consistently late, that negative information can also be reported. This could actually hurt your credit score, making it lower instead of higher. A lower credit score can make it harder to get approved for other types of loans or credit in the future, and if you do get approved, you might end up with higher interest rates. So, it's a bit of a double-edged sword, you know?

Basically, sites like Fingerhut no down payment can be a really useful tool for building credit, especially if you're just starting out or trying to improve a less-than-perfect credit past. But it really comes down to your own commitment to making those payments on schedule. If you use them responsibly, they can certainly be a step towards a stronger financial future. It's all about being disciplined with your payment plan.